What Does Mileagewise - Reconstructing Mileage Logs Do?

What Does Mileagewise - Reconstructing Mileage Logs Do?

Blog Article

Excitement About Mileagewise - Reconstructing Mileage Logs

Table of ContentsAbout Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Can Be Fun For EveryoneMileagewise - Reconstructing Mileage Logs - TruthsThe Buzz on Mileagewise - Reconstructing Mileage LogsFacts About Mileagewise - Reconstructing Mileage Logs UncoveredMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedMileagewise - Reconstructing Mileage Logs Fundamentals Explained

Timeero's Quickest Distance attribute recommends the shortest driving course to your employees' destination. This attribute enhances performance and adds to cost financial savings, making it a necessary possession for companies with a mobile workforce. Timeero's Suggested Path function additionally enhances liability and performance. Workers can compare the recommended path with the real route taken.Such a strategy to reporting and conformity streamlines the usually complicated task of handling mileage costs. There are several advantages linked with using Timeero to keep track of mileage.

Our Mileagewise - Reconstructing Mileage Logs Ideas

With these tools in usage, there will be no under-the-radar detours to raise your repayment prices. Timestamps can be found on each gas mileage access, improving reliability. These additional confirmation steps will certainly keep the internal revenue service from having a factor to object your mileage documents. With accurate mileage monitoring technology, your staff members don't need to make harsh mileage price quotes or also stress over mileage expenditure monitoring.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all automobile expenditures (mileage tracker app). You will certainly need to proceed tracking gas mileage for work even if you're utilizing the actual expenditure approach. Maintaining mileage records is the only means to separate organization and individual miles and supply the proof to the IRS

Many gas mileage trackers let you log your trips manually while determining the distance and repayment quantities for you. Numerous also included real-time trip monitoring - you require to start the app at the beginning of your journey and stop it when you reach your last destination. These apps log your begin and end addresses, and time stamps, along with the overall distance and reimbursement amount.

Indicators on Mileagewise - Reconstructing Mileage Logs You Should Know

This includes costs such as fuel, maintenance, insurance coverage, and the lorry's depreciation. For these costs to be taken into consideration deductible, the vehicle should be made use of for organization functions.

The 5-Second Trick For Mileagewise - Reconstructing Mileage Logs

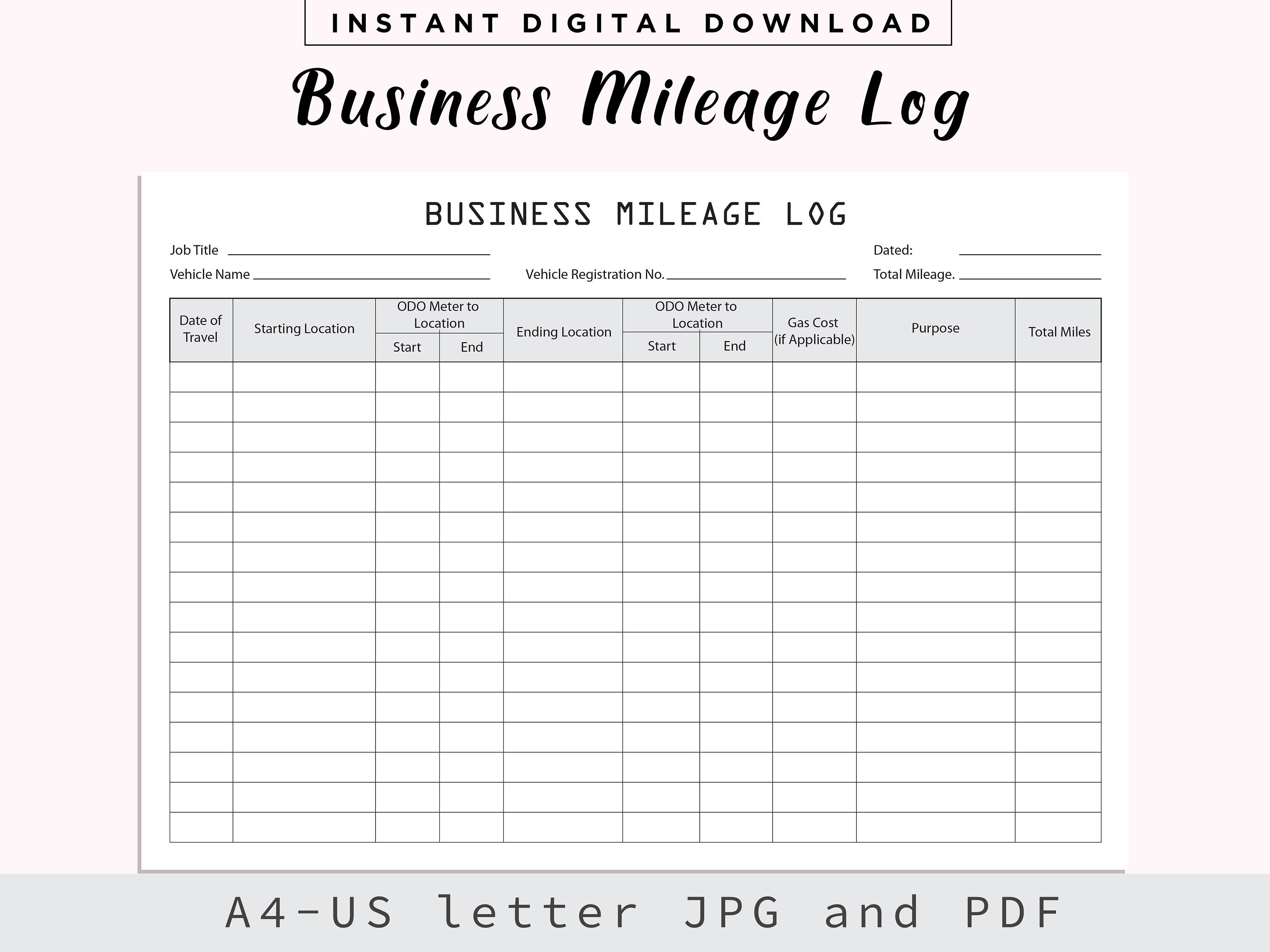

Begin by tape-recording your cars and truck's odometer analysis on January first and after that once again at the end of the year. In in between, vigilantly track all your business journeys writing the starting and ending readings. For every trip, document the area and business purpose. This can be streamlined by maintaining a driving visit your automobile.

This consists of the total business gas mileage and complete gas mileage accumulation for the year (company + individual), trip's day, location, and objective. It's necessary to record tasks immediately and preserve a coeval driving log detailing date, miles driven, and company purpose. Here's exactly how you can boost record-keeping for audit functions: Start with making sure a precise mileage log for all business-related traveling.

Fascination About Mileagewise - Reconstructing Mileage Logs

The real expenditures method is an alternate to the common mileage price method. Rather than determining your reduction based on a fixed price per mile, the actual costs approach enables you to subtract the actual expenses related to utilizing your lorry for company functions - mile tracker app. These prices consist of gas, maintenance, fixings, insurance coverage, devaluation, and other related expenses

Nevertheless, those with substantial vehicle-related costs or distinct conditions may profit from the actual costs method. Please note choosing S-corp condition can alter this estimation. Ultimately, your picked approach must line up with your details economic goals and tax circumstance. The Standard Gas Mileage Price is a measure released each year by the IRS to establish the deductible prices of running a vehicle for service.

Our Mileagewise - Reconstructing Mileage Logs Diaries

(https://generous-panda-mznbs9.mystrikingly.com/blog/the-best-mileage-tracker-app-for-perfect-mileage-logs)Determine your complete business miles by using your begin and end odometer analyses, and your taped service miles. Properly tracking your exact mileage for business trips help in corroborating your tax obligation reduction, especially if you decide for the Criterion Mileage method.

Keeping an eye on your gas mileage manually can call for persistance, yet remember, it can conserve you money on your taxes. Follow these actions: Document the day of each drive. Tape-record the complete mileage driven. Think about noting your odometer readings before and after each journey. Write down the beginning and ending factors for your journey.

The 10-Minute Rule for Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline company market came to be the very first industrial users of general practitioner. By the 2000s, the delivery industry had actually adopted general practitioners to track packages. And now almost everyone uses general practitioners to get about. That suggests nearly everyone can be tracked as they see this here set about their company. And there's snag.

Report this page